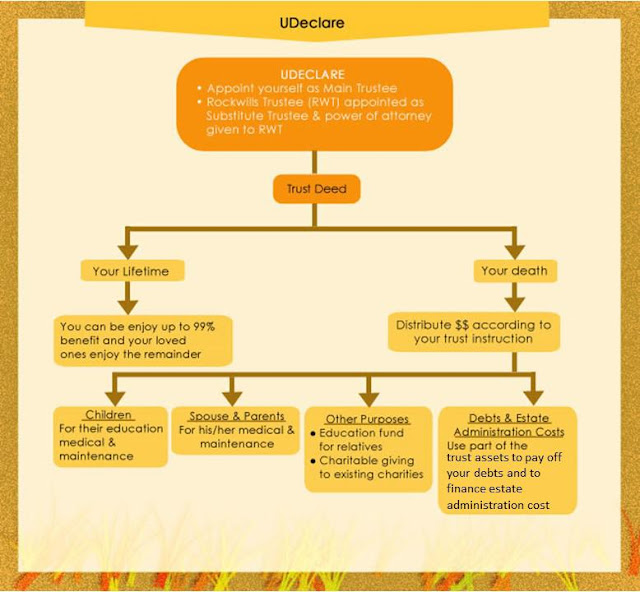

Our UDeclare is a Declaration of Trust that is simple, flexible and powerful providing for your loved ones and securing their financial well-being. Under UDeclare, a trust is set up by you as trustee with Rockwills Trustee as your back up trustee. This prevents any delay in allowing your beneficiaries to enjoy the trust assets.

In our UDeclare, you need not transfer the assets yet, until any of the following events (as determined by you) occurs:

> Death

> Total Permanent Disability (TPD)

> Critical Illness

> Mental Disability

> Resignation as trustee

> Disappearance for a period of time

You may also include other specific events to enable us to act as trustee.

Benefits of UDeclare:

* Speedy distribution

UDeclare prevents delay and provides for fast distribution to your beneficiaries in their time of need or it can be accumulated for a specified period.

* Control

When you act as the Trustee, you will have full control of the assets placed into the Trust.

* Flexibility

During your lifetime, you can be one of the beneficiaries in the trust. So, at any time, you will be able to withdraw your portion in UDeclare when there is a need to do so.

* Cost savings

When you are acting as the trustee, there are no transfer costs involved to Rockwills Trustee so you will be able to save on certain fees such as stamp duty, legal fees and the trustee’s annual fee.

* Continuity

As Rockwills Trustee Bhd is your backup trustee, your instructions in you Trust will continue to be carried out providing for your during illness and disability and to your beneficiaries when you are no longer around.

* Impartiality

Your beneficiaries will also benefit from our independent position as we shall act impartially and fairly to all beneficiaries. This safeguards their individual interests in the trust.

* Protection for your beneficiaries

With the appointment of a Protector as a watchdog and advisor to the trustee, there is clear protection of your beneficiaries’ interest.

* Professional & Experienced

By appointing Rockwills Trustee as your substitute trustee, you ensure that your instructions in the trust are carried out by a professional and experienced trustee.